March 31, 2024

Palladium Investing: Assertive Focus on the Trend, Ignore the Noise

In the dynamic arena of investing in precious metals, palladium stands out as a potent commodity that captures global attention. Despite its recent volatility, the intricate interplay of demand and supply fundamentals and its critical industrial uses make palladium an enticing prospect for discerning investors. This essay aims to unwrap the complexities of palladium investing, with a targeted focus on the overarching trends while sidestepping the peripheral noise. We will touch upon mass psychology’s intriguing role, technical analysis’s power, and the latent opportunities within fear-driven market lows. Furthermore, we will delve into the rising global demand, driven by environmental considerations, and the potential impact of geopolitical tensions on palladium’s prospects.

Exploring the Potential: Palladium as an Investment Highlight

When surveying the landscape of precious metals, which includes stalwarts like Gold, Silver, Platinum, and Palladium, it’s Palladium that emerges as the standout candidate for investment. While Gold and Silver remain solid choices for a long-haul strategy, they seem to be in a phase of consolidation, gathering the energy needed for a more significant ascent. Expectations are set for Gold to eventually breach the $2400 mark and for Silver to make strides toward the $39 to $45 zone, with an outside chance of soaring as high as $60. Yet, it is prudent to hold off on such ambitious targets until Silver surpasses $45. Market Update January 15, 2024

Palladium is an exception and the most undervalued among its peers. Moreover, it is currently deemed the most undervalued across all markets. Gold and Silver are momentarily in a holding pattern, having already made impressive gains from their respective lows—gold from around $1600 and Silver from $17.50 in September 2022. The long-term view remains positive; however, the present calls for a disciplined approach.

Silver, in particular, is showing more promise than Gold in the weekly charts, potentially testing the $24-$25 range soon. Yet, both metals will likely see fluctuations until their monthly chart formations indicate a firmer, bullish trend, which has yet to materialize.

Palladium, on the other hand, may prove to be a catalyst for remarkable market movements. Its market, less liquid than Gold and Silver, is prone to sharp swings, often orchestrated by major market players.

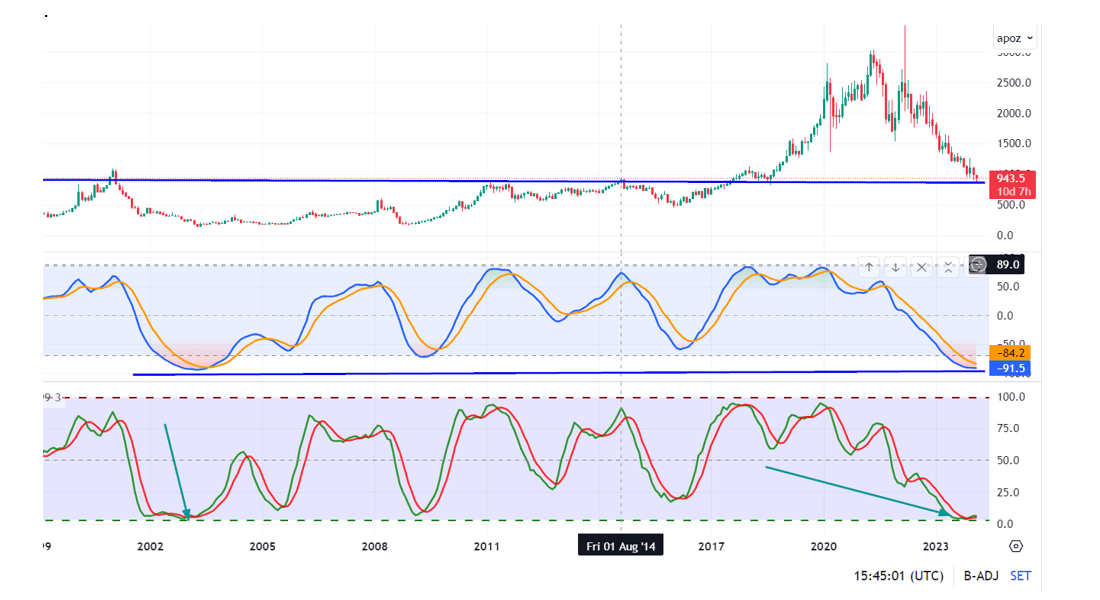

Moreover, Palladium’s status across quarterly, monthly, and weekly timelines is remarkable, ranging from highly undervalued to staggeringly so. Such a setup is uncommon and could foreshadow a dramatic upswing.

The monthly chart for Palladium reveals an extraordinary situation: Over 15 of our custom indicators are flagging the most undervalued readings since 2002. Nonetheless, as Tactical Investors, we must remember the wisdom of diversification and resist the urge to overcommit to a single asset.

For those with a speculative streak, it may be wise to reallocate funds from non-essential expenditures to more adventurous investments. Money lying idle could be channelled into higher-risk, potentially higher-reward opportunities. Embracing a more modest lifestyle, perhaps one or two notches below one’s means can unlock capital for such ventures. Considering the tendency for overspending, merely living within one’s financial limits can be an effective strategy. The savings generated from this lifestyle shift can be strategically invested. Further insights into frugal living can be found in the section titled “Thriving by Living below your means.”

Invoking the wisdom of the ancient philosopher and investor Thales of Miletus, who famously secured options on olive presses and profited from a season of bountiful harvests, we understand the value of strategic positioning in anticipation of market movements. Thales’ approach underscores the potential of foresight and tactical investments, a philosophy that aligns with seizing the undervalued opportunity that Palladium currently represents.

Similarly, reflecting on contemporary investment strategies, Warren Buffett’s adage of being “fearful when others are greedy, and greedy when others are fearful” resonates with the current Palladium scenario. Buffet’s axiom suggests that the current undervaluation of Palladium may indeed be the opportune moment for the astute investor to act, counter to the prevailing market sentiment.

In conclusion, Palladium’s current market position offers a unique investment opportunity for those willing to apply the lessons from history and adhere to modern investment principles. As always, a balanced and thoughtful approach to allocation will serve investors well in navigating the volatile terrain of precious metals.

The Role of Mass Psychology in Palladium Investing: A Deeper Dive

Investor behaviour, particularly the psychological phenomenon known as FOMO (Fear of Missing Out), plays a crucial role in the palladium market. This fear often drives prices to historic highs before a significant pullback occurs, as witnessed in the recent palladium market fluctuations. This pattern creates a fertile ground for contrarian investors, who look beyond short-term sentiment to the fundamental value of the market.

For instance, in the early 2000s, palladium prices dropped precipitously due to a sudden surplus. However, contrarian investors who defied the pessimistic sentiment and invested in palladium ultimately witnessed substantial returns when prices rebounded in the following years.

FOMO is not exclusive to the palladium market but is a common phenomenon in various investment sectors, including cryptocurrencies and high-tech investments. The fear of missing out on a potentially lucrative investment can lead to overtrading and irrational decision-making For example, investors may rush to invest in a trending asset, driving up its price, only to see it crash when the trend reverses,.

New investors or those who have recently come into significant wealth can be especially susceptible to FOMO. The excitement of potential gains can overshadow the inherent risks of investment, leading to decisions driven more by emotion than by objective analysis.

However, savvy investors can use the understanding of mass psychology to their advantage. By resisting the temptation to follow the crowd and instead focusing on the fundamental value of an asset, they can make more informed investment decisions. For example, when most investors are selling out of fear during a market downturn, a contrarian investor might see an opportunity to buy assets at a discount, anticipating a future recovery.

Palladium Investing: Navigating Market Sentiment

Investing effectively often involves identifying opportunities during market downturns, typically driven by widespread fear. The 2008 financial crisis, for instance, saw a significant drop in palladium prices. Investors recognising this as an opportunity rather than a setback could capitalize on the subsequent market recovery for considerable gains.

This approach is not unique to palladium but is a strategy employed by successful investors across various asset classes. Warren Buffett, for example, is known for his contrarian approach, often buying during bear markets when valuations are depressed. This strategy hinges on the understanding that market sentiment can unduly affect the price of both strong and weak companies, creating opportunities for discerning investors.

However, this method requires a thorough understanding of market dynamics and maintaining emotional discipline. Fear can prompt hasty decisions, such as selling during a downturn, resulting in missed opportunities when the market rebounds. It also necessitates patience and a long-term perspective, as recovery and realising gains can take time, as evidenced by the post-2008 financial market recovery.

Palladium’s Strategic Role in Environmental Sustainability and Market Dynamics

Palladium is increasingly critical in the push for cleaner automotive technology, primarily due to its role in catalytic converters, which reduce vehicle emissions. With over 85% of palladium demand driven by the automotive sector, stricter global emission regulations are expected to boost its demand further.

The recent semiconductor shortage has temporarily dampened this demand, but a rebound in the semiconductor industry could quickly revitalize palladium needs. Additionally, geopolitical tensions, particularly involving Russia—a key palladium producer—pose risks to supply chains, potentially leading to price volatility.

Looking ahead, palladium may find new applications in the hydrogen energy sector, potentially amplifying demand. However, risks such as a global economic downturn or the emergence of cheaper alternatives to palladium in catalytic converters could impact its market.

Investors considering palladium must monitor these factors closely, balancing the metal’s environmental significance with economic and geopolitical influences.

Conclusion:

In summary, successful palladium investing requires a focused and contrarian strategy. Investors can position themselves as an advantage by navigating market noise and emphasizing mass psychology, technical analysis, and seizing opportunities during fear-driven lows. The current state of the palladium market, marked by recent price shifts, presents a potential entry point for those with a long-term perspective.

Understanding mass psychology, especially the Fear of Missing Out (FOMO), provides insight into market behaviour. Contrarian investors, recognizing value beyond short-term sentiment, historically capitalize on opportunities created by fear-driven market fluctuations. Technical analysis is a valuable tool, allowing investors to navigate the volatile palladium market by identifying trends and making well-timed decisions. Additionally, viewing fear-driven market lows as opportunities rather than setbacks aligns with the fundamental principle of buying low and selling high.

Despite recent price declines, palladium’s role in critical industries, such as automotive and electronics, underscores its intrinsic value. Supply dynamics, intricately linked to platinum and nickel mining, introduce geopolitical and operational risks that savvy investors should consider. The concentrated nature of palladium reserves and the challenges of developing new mines contribute to its appeal as a scarce resource.

For contrarian investors, the current market conditions, shaped by emotional reactions and supply-demand fundamentals, present a compelling opportunity. It is crucial, however, to approach palladium investing with a comprehensive understanding of the market, conducting thorough research, and carefully assessing associated risks. In doing so, investors with a long-term perspective may find the present state of the palladium market as an attractive entry point for potential gains.

Embark on New Narratives: Explore Further

How To Get Financial Freedom Fast: Escape the Herd for Lasting Success

Giving Content to Investor Sentiment: The Role of Media in The Stock Market

Considering the impact of inflation, Why Is Investing Important?

Technical Analysis of Stocks and Commodities: Unveiling Insights

Why Is the US Education System So bad: Rubbish In, Rubbish Out Phenomenon

Investor Sentiment in the Stock Market Journal of Economic Perspectives

Mass Psychology of Fascism: Unmasking Bombastic News

Real Doppelgangers: The Risks in the Age of AI

The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment Trusts

TGB Stock Forecast: Rising or Sinking

Reasons Why AI Is Bad: The Dark Truth?

The Inflationary Beast: Understanding What Inflation is and What Causes It

Identifying Trends and Buying with Equal Weighted S&P 500 ETF

Psychology of Cursing: Why Do People Curse So Much?